Get notified when the pre-sale starts.

Don’t miss the opportunity to purchase RUT and get exclusive access to tokenized mortgage notes!

Don’t miss the opportunity to purchase RUT and get exclusive access to tokenized mortgage notes!

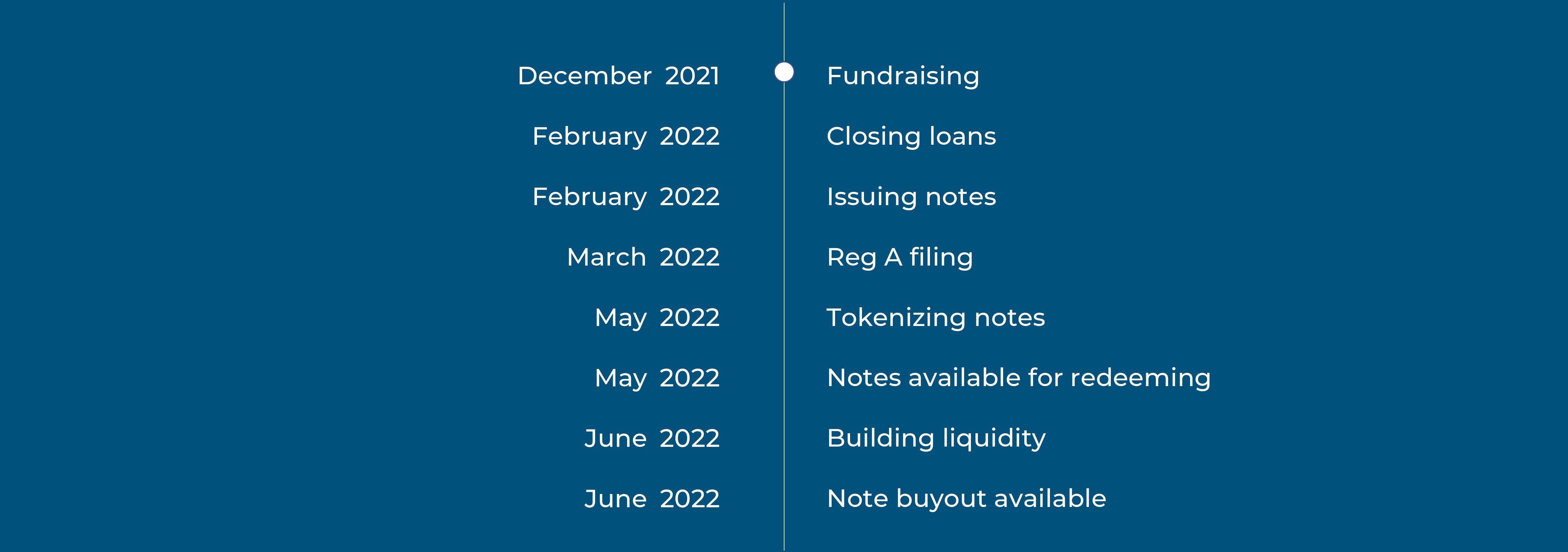

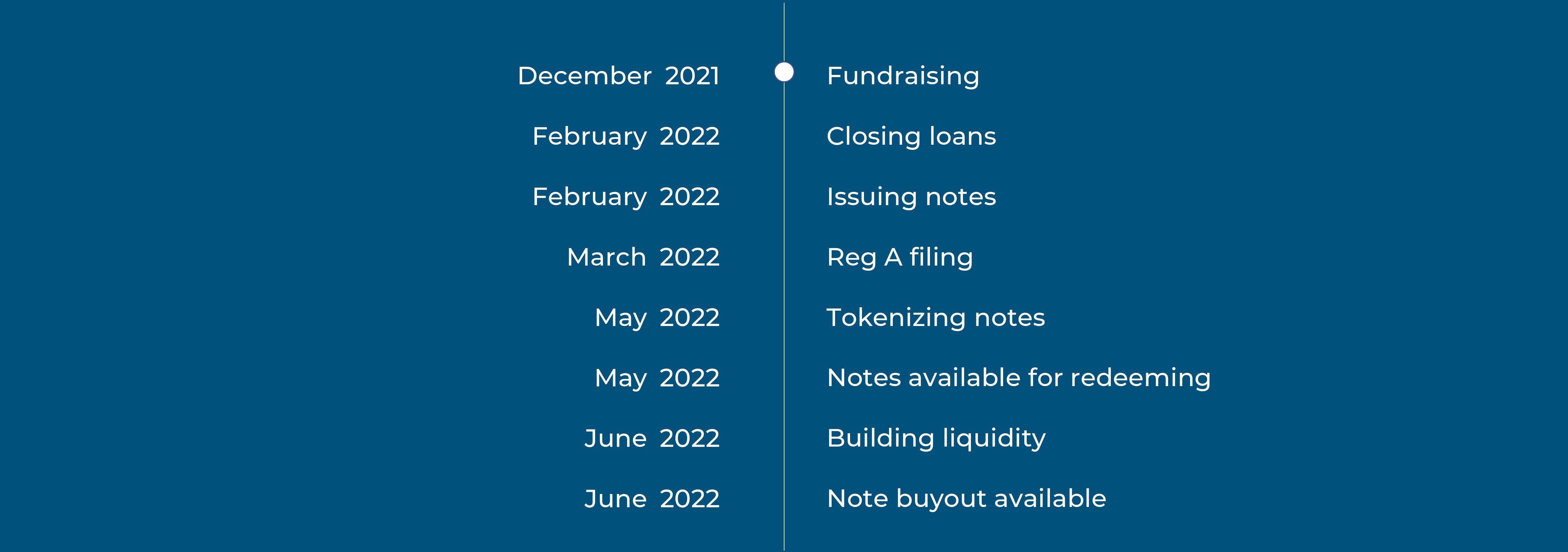

REINNO is raising $50M to finance its instant fractional loans collateralized by tokenized commercial real estate and give retail investors access to a previously closed market. Most often, loan financing comes from institutional investors: endowment funds, commercial banks, mutual funds, hedge funds, pension funds, and insurance companies. It’s time to democratize this opportunity and make it available to everyone!

REINNO will reward early supporters participating in the pre-sale with governance tokens!

Invest in tokenized mortgage notes to earn low-risk, low-maintenance passive income.

Investment profile

Stable yield around 4%

Stable yield around 4% Projected maturity is 6 years

Projected maturity is 6 years Team expertise

Team expertise Buyback available *

Buyback available * Free governance tokens

Free governance tokens* Investors can sell their notes to REINNO, even if they are non-performing!

As a token of appreciation for early supporters, REINNO is giving governance tokens to the RUT buyers participating in the pre-sale. Governance token holders will receive a share of profits generated by the tokenized mortgage notes program, including transaction fees and profits generated by the unclaimed notes. The governance tokens will also have voting rights and can be later traded on secondary markets.

Don’t miss the opportunity to purchase RUT and get exclusive access to tokenized mortgage notes!

1. Collateralized by tokenized commercial real estate

2. All properties are located in the U.S.

3. Powered by AI valuations (average deviation from the actual asset price is 0.05% while the human assessment deviation is around 5%)

4. Following tried industry standards for underwriting and due diligence

Review the whitepaper

Follow REINNO on social media and be the first to know about the latest updates.

Check our knowledge base for frequently asked questions.

Stay up to date with our news, special monthly reports, announcements and events REINNO’s attending